Market context and why this analysis matters

New Jersey’s power market is entering a compressed moment where politics, prices, and physics collide as customer bills jump, PJM’s reserve margin tightens, and large-load demand from data centers accelerates right when a new administration makes affordability and in‑state supply the top priorities. The result is not just another rate case narrative but a live test of whether a utility can exchange short‑term relief for permission to build long‑lived assets that cut risk and stabilize costs over time. This analysis explores how that trade could work, what it means for PSEG’s earnings path, and where legislation and federal policy might accelerate or stall the shift.

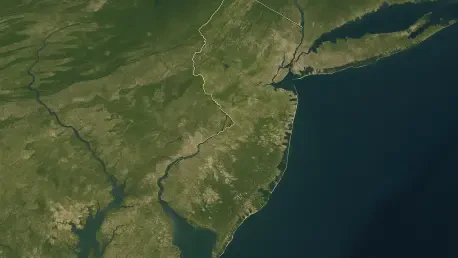

Purposefully, the focus is on the mechanics of the swap: smoothing bills now via timing and recovery levers in exchange for durable support to expand regulated investments in storage, local generation, and grid capacity. Because New Jersey imports about 40% of its power and faces long interconnection queues, a credible plan for in‑state resources has market value beyond politics—it can lower volatility, improve capacity outcomes, and attract capital at lower risk premia.

The stakes are immediate. PSEG’s latest quarter showed a 20% earnings increase to $620 million and roughly $1.8 billion year‑to‑date, while retail sales were flat on a weather‑normalized basis and summer bills climbed about 36% excluding temporary credits. That combination—strong results alongside affordability pressure—creates room for a rates‑for‑build bargain under a governor‑elect who campaigned on a rate freeze, emergency action on utility costs, and sharper transparency from utilities and PJM.

Demand, supply, and policy signals reshaping the outlook

Affordability has become the organizing principle of the market. Analysts interpret PSEG’s tone as open to near‑term concessions, such as extending cost recovery timelines, deferring riders, or resequencing projects to flatten bill impacts. The financial math works if execution is disciplined: spreading recovery increases carrying costs but can preserve capital formation for assets that relieve peaks, reduce congestion, and enable cheaper clean supply. Politically, such a glidepath aligns with a promised rate freeze and can be paired with scorecards that tie investment to reliability and customer outcomes.

Policy constraints are loosening. Companion bills S4306 and A5439 would allow utility ownership of generation—currently prohibited—and target resources like solar and storage at constrained nodes, brownfields, and landfills. In a PJM environment with tighter capacity and slow merchant interconnections, regulated ownership can reduce financing costs and speed delivery, provided procurement is transparent and capped by performance‑based safeguards. The trade‑off is classic: less merchant risk but more regulatory oversight and consumer protection.

Load shape is changing faster than retail sales. Large‑load inquiries reached 11.5 GW, up 22% quarter over quarter, with roughly one‑fifth likely to materialize. The “mature” data center queue rose to 2.8 GW, and a Kenilworth‑area facility targets 100 MW in 2027, scaling to 300 MW by 2029. These sites require firm, low‑carbon, high‑reliability power—an attribute set that pairs well with PSEG’s 3,758‑MW nuclear fleet, including a planned 200‑MW uprate at the 2,285‑MW Salem plant across 2027‑2029. While renewables and batteries are critical, continuous, high‑density loads still depend on dispatchable capacity; a balanced portfolio becomes a commercial necessity rather than a preference.

Affordability pressure and rate strategy

A credible affordability plan leans on three tools: timing, targeting, and transparency. Timing spreads recovery for near‑term relief without amputating the capex program; targeting directs spend to grid pinch points where storage, reconductoring, or substation upgrades reduce congestion costs; transparency uses simple metrics—bill impact, outage minutes, interconnection speed—to validate benefits. If adopted, these measures can provide political cover for a larger rate base tied to reliability outcomes.

The risk is complacency on cost discipline. Rate smoothing must be coupled with tighter project controls—milestone gating, standardized EPC contracts, and shared‑savings constructs—to prevent drift that erodes the value of the relief. Done well, the glidepath becomes bridge finance to a more resilient system; done poorly, it becomes deferred pain.

In‑state generation and ownership reforms

Allowing utility ownership of select assets does not eliminate competition; it reframes it. Competitive solicitations can invite merchant, independent power, and utility proposals under uniform cost and performance standards. Utility‑owned storage offers a regulated reliability product, while third parties compete for energy arbitrage and renewable output. This hybrid can mobilize both low‑cost regulated capital and private innovation while aligning siting with grid needs.

Guardrails matter. Caps on utility share, open books on costs, and performance incentives tied to capacity and availability reduce ratepayer exposure. If legislation passes, expect a wave of landfill solar, distribution‑connected batteries at feeders serving data campuses, and substation‑level upgrades sequenced with interconnections.

Data centers, nuclear, and portfolio design

Data campuses introduce 24/7 procurement needs that standard renewable PPAs do not meet on their own. Tailored offerings—green tariffs with hourly matching, contracts anchored by nuclear plus storage, and demand flexibility to trim capacity charges—can secure long‑duration commitments that justify local investments. For PSEG, nuclear becomes both reliability backstop and commercial wedge to attract long‑term load.

A common misconception is that storage alone can solve continuous demand. In practice, multi‑hour batteries mitigate peaks and imbalance, but firm, low‑carbon generation remains essential. The near‑term efficient path is a portfolio that blends nuclear baseload, strategically sited storage, incremental transmission, and targeted efficiency to flatten ramps.

Forecast and scenarios for investment and bills

The base case assumes rate smoothing, selective utility‑owned storage, and accelerated interconnections for projects that demonstrably relieve constraints. Bills stabilize as recovery extends, while capex tilts toward reliability‑linked assets. Nuclear uprates proceed on schedule, and green tariffs emerge for large loads seeking 24/7 alignment. The result is modest bill pressure with improving resilience and clearer offtake structures for data centers.

An upside case emerges if S4306/A5439 pass quickly and federal action clarifies rights and timelines for large‑load interconnections. Under that setup, landfill solar, feeder‑level batteries, and brownfield projects scale faster, congestion costs fall, and capacity outcomes improve. Financing costs decline as regulatory visibility rises, and data center commitments lock in multi‑year demand certainty.

A downside case hinges on policy delay and persistent PJM bottlenecks. Without legislative movement or queue reform, merchant projects slip, capacity tightness lifts prices, and affordability pressure intensifies. Utilities then face a harder choice: deeper deferrals that undermine reliability or sharper bill spikes that erode goodwill. In that world, even strong earnings cannot offset deteriorating customer sentiment.

Base case: rate smoothing plus targeted build

Expect elongated amortization for select riders, a queue triage that prioritizes reliability value, and a measured expansion of regulated storage. Data centers adopt blended portfolios—nuclear plus renewables plus storage—with demand response to cut capacity charges. Bill trajectories flatten while outage metrics improve.

Upside case: legislative green light and faster queues

If ownership reform and interconnection clarity arrive together, procurement shifts to competitive, technology‑neutral solicitations where utilities can own under caps. Constrained‑site solar and station‑adjacent batteries move first, reducing congestion quickly. Large loads secure hourly matched tariffs, supporting deeper decarbonization.

Downside case: policy delays and capacity stress

Absent reform, capacity pricing and congestion keep pressure on bills. Utilities lean on efficiency and small‑scale upgrades, but large‑load timelines slip. Investor focus pivots to defensive assets and lower‑risk recovery mechanisms.

Strategic implications and investor lens

For policymakers, pairing immediate bill relief with scorecard‑based recovery can unlock consensus. Clear amortization rules, affordability riders with sunset provisions, and transparent metrics anchor trust. For utilities, sequencing capex to relieve local constraints first delivers the fastest customer wins and political support, while standardized contracts and milestone gating protect budgets.

Large‑load customers gain by co‑funding network upgrades that accelerate timelines and by adopting 24/7 supply constructs that blend nuclear, renewables, and storage. Investors should prioritize assets with strong regulatory compacts—regulated storage, targeted transmission, and efficiency—while watching ownership legislation as a catalyst for accelerated capital deployment and lower risk.

Conclusion: near‑term moves and measurable milestones

The analysis pointed to a pragmatic bargain: short‑term rate smoothing in exchange for investment authority that targets reliability and local supply. The most credible next steps were simple and verifiable—extend recovery on defined riders, publish affordability and reliability scorecards, prioritize interconnections with demonstrable congestion relief, and pilot green tariffs that pair nuclear with storage for data campuses. If ownership reform advanced, constrained‑site solar and distribution‑connected batteries moved to the front of the line with clear caps and accountability. That combination reduced volatility, protected customers, and created room for disciplined growth, positioning New Jersey to bend costs and emissions down while meeting a very different kind of load.