In a decisive move to address an unprecedented surge in electricity demand, CMS Energy, the parent company of Consumers Energy, has unveiled an ambitious and extensive capital investment strategy that will inject over $17 billion into its operations over the next five years. This landmark financial commitment is aimed at substantially upgrading and expanding the company’s generation, distribution, and other critical assets across its Michigan service territory. The plan represents a significant scaling up of operations, strategically designed not only to meet the voracious energy needs of a growing industrial and data center landscape but also to align with the state’s aggressive clean energy mandates, heralding a transformative period for the region’s power infrastructure. This proactive investment framework underscores the utility’s recognition of a fundamental shift in energy consumption patterns and its intent to build a more resilient, powerful, and sustainable grid capable of supporting Michigan’s economic future.

The New Power Consumers Driving a Strategic Shift

The primary impetus for this massive capital outlay is the utility’s projection of significant and sustained load growth, a trend overwhelmingly fueled by the rapid expansion of the data center industry and other large-scale industrial operations. Consumers Energy is forecasting a notable 3% increase in weather-normalized electricity sales for 2026 alone, which translates to an additional 38,000 gigawatt-hours of consumption. Beyond that, the utility anticipates maintaining a robust growth rate of 2% to 3% annually through the end of the decade. This expected surge in demand has necessitated a proactive and forward-looking investment strategy, particularly in the realm of power generation. To manage the financial impact of integrating these high-demand clients, the Michigan Public Service Commission approved a large load tariff proposal in November. This regulatory instrument includes crucial provisions designed to insulate existing ratepayers from bearing the substantial costs associated with building out the infrastructure required to serve these new energy-intensive customers.

Reinforcing the urgency of this expansion, company leadership has confirmed it is in the final stages of negotiation with several major clients poised to become significant power consumers in the region. Among the most prominent of these is a prospective rate contract for a 1-gigawatt data center with an as-yet-unnamed “hyperscaler,” a term for a massive cloud computing and data processing company. While investment analysts expressed mild disappointment that the deal was not yet finalized during a recent earnings call, the clear progress was viewed as a positive indicator of future growth. CEO Garrick Rochow further revealed an extensive pipeline of potential projects, which includes approximately 9 gigawatts of large-load interconnection requests. Of this total, up to 2 gigawatts are already in the final stages of negotiation. This momentum is further bolstered by recent interest from two additional proposed data centers and two new industrial loads, leading Rochow to express strong confidence in securing multiple large-load agreements in the near future.

A Two-Pronged Approach to Generation

A central pillar of the $17 billion investment plan is a profound and long-term commitment to renewable energy, which directly aligns with Michigan’s state law mandating a transition to 100% carbon-free electricity by the year 2040. A substantial portion of the capital is earmarked for the development of renewable generation and its associated infrastructure. The company has laid out a long-term roadmap to invest approximately $14 billion through 2045 to construct a massive renewable portfolio, with ambitious targets of building 8 gigawatts of solar power and 2.8 gigawatts of wind power. In the more immediate future, the five-year plan through 2030 allocates roughly $8.8 billion to electric generation. This figure represents a staggering $2.5 billion increase from the company’s prior five-year strategy, a clear signal of the accelerated pace and heightened urgency behind the utility’s transition away from fossil fuels and toward a cleaner, more sustainable energy mix for its customers.

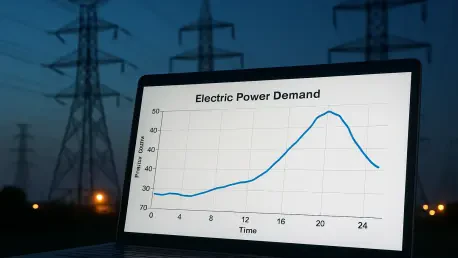

However, the rapid growth in demand combined with the intermittent nature of renewables presents a significant challenge to grid stability, creating what executives have termed a prospective “gap in capacity.” This shortfall is expected to widen as older thermal generators, such as the Kern 3 and 4 oil-fired peaker plants scheduled for decommissioning in 2031, are retired from service. The potential new large-load customers are not accounted for in the utility’s previously approved resource plans, making it imperative to find a solution to ensure the grid remains reliable around the clock. To address this, CEO Garrick Rochow stated that the capacity gap will need to be filled with “firmer resources.” He explicitly identified advanced battery storage systems and flexible natural gas plants as essential components of the future energy mix, serving as crucial complements to balance the grid when solar and wind power are unavailable. The substantial increase in projected generation spending is a direct reflection of the investments that will be detailed in the company’s forthcoming Integrated Resource Plan (IRP).

Managing Legacies and Future Mandates

The strategic discussions also included an update on the complex situation surrounding the J.H. Campbell coal-fired power plant. Originally slated for retirement in May 2025 as part of the utility’s clean energy transition, the 1.6-gigawatt facility has been the subject of multiple emergency orders from the U.S. Department of Energy (DOE). Citing pressing concerns of a potential generation shortfall in the MISO northern region, the DOE has mandated that the plant remain operational beyond its planned closure date to ensure regional grid reliability. This decision has not been without controversy, drawing opposition from environmental groups and some large customers who advocate for an accelerated move away from coal. While Consumers Energy has previously estimated the cost of extending the plant’s operation at around $80 million through September 2025, no new financial figures were provided during the recent update.

Despite the current federal mandates requiring the J.H. Campbell plant to continue operating, company leadership made it clear that its eventual retirement remains a long-term objective. During the earnings call, CFO Rejji Hayes hinted at the plant’s ultimate closure, noting that significant cost savings would be realized once the company is fully “out of coal.” This statement suggested that while the utility must comply with the DOE’s emergency orders in the short term, the overarching strategy to phase out its coal fleet remains firmly in place. The situation underscored the delicate balance the company must strike between meeting immediate reliability needs, complying with federal directives, and adhering to its long-term decarbonization goals. The plan to fill the capacity gap with a combination of renewables, battery storage, and natural gas was presented as the definitive pathway forward, marking a strategic pivot that accommodated both the new industrial demand and the eventual retirement of legacy fossil fuel assets.