I’m thrilled to sit down with Christopher Hailstone, a seasoned expert in energy management and renewable energy, with a deep understanding of electricity delivery systems. As our go-to utilities specialist, Christopher has a keen eye on grid reliability and security, making him the perfect person to unpack the complex dynamics of utility regulation in Indiana. Today, we’ll dive into Governor Mike Braun’s urgent call for lower utility rates, the staggering bill increases hitting Hoosier households, and the unexpected shake-up at the Indiana Utility Regulatory Commission. We’ll explore the implications for residents, businesses, and utility companies, as well as the broader challenges of balancing affordability with growing energy demands.

How do you interpret Governor Braun’s strong statement, “We can’t take it anymore,” about high utility rates in Indiana, and what underlying issues might have driven this frustration?

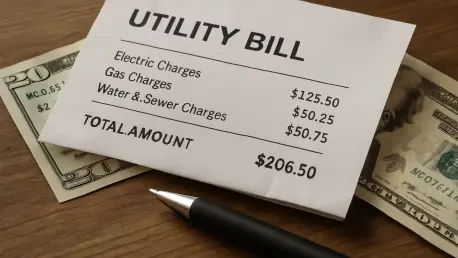

I think Governor Braun’s statement reflects a boiling point for many Indiana residents who’ve been grappling with skyrocketing utility bills. The frustration likely stems from the sheer scale of recent rate hikes—average residential electric bills jumped 17.5% in just one year, according to the Citizens Action Coalition. That’s a massive hit for families and small businesses, especially in a state where incomes aren’t always keeping pace. Beyond that, there’s a growing perception that utility companies are prioritizing profits over people, and I believe the governor is channeling that widespread discontent into a call for action.

What impact do you think the governor’s push for lower rates might have on the relationship between the state and major utility companies operating in Indiana?

It’s likely to create some tension. Utility companies like Duke Energy and NiSource operate under a regulated framework where rate increases are often justified by infrastructure investments or rising operational costs. When the governor publicly pressures them to lower rates, it signals a potential shift toward stricter oversight or even adversarial negotiations. However, these companies are also key economic players, so the state will need to balance this push with maintaining a business-friendly environment. It could lead to more contentious rate case hearings or push utilities to propose more creative cost-saving measures.

Governor Braun has tasked the new ratepayer advocate with evaluating utility profits and identifying cost-saving measures. What kinds of reforms or changes do you anticipate might emerge from this process?

This evaluation could uncover opportunities to streamline operations or rethink how costs are allocated. For instance, the advocate might push for greater transparency in how utilities justify rate hikes or propose performance-based regulation, where companies are incentivized to meet efficiency or reliability targets. There could also be a focus on deferring non-essential capital projects to ease short-term ratepayer burdens. However, any reforms will need to be carefully crafted to avoid undermining the financial stability of utilities, which is critical for maintaining grid reliability.

The governor suggested that utility investors should bear more of the cost of doing business. How feasible do you see this idea, and what might be the reaction from the investment community?

It’s a bold idea, but challenging to implement. Utilities operate on a model where investors expect stable returns, often guaranteed through regulated rates. Asking them to absorb more costs could spook investors, potentially raising capital costs for utilities as they seek funding for infrastructure upgrades. While it’s possible to adjust the balance of risk through regulatory mechanisms, investors might push back hard, arguing that it undermines the predictability of their returns. It’s a delicate dance—too much pressure could impact the utilities’ ability to fund necessary projects.

Turning to the sharp rise in utility bills, what do you believe are the primary drivers behind the 17.5% average increase for residential electric bills in Indiana over the past year?

Several factors are at play here. First, there’s the rising cost of fuel and generation, especially as utilities transition away from coal to natural gas or renewables, which can involve upfront investments. Second, many utilities are recovering costs from major infrastructure upgrades—think grid modernization or storm hardening—that get passed on to consumers. Lastly, inflation has driven up operational expenses across the board. These costs compound, and unfortunately, residential customers often feel the brunt of it in their monthly bills.

NIPSCO saw the highest bill increase in the state at 26.7% this year. Can you shed light on why their rates spiked so dramatically compared to other utilities?

NIPSCO’s situation is unique due to a combination of factors. They’ve been heavily investing in transitioning their generation mix, moving away from coal to cleaner sources, which comes with significant capital costs. Additionally, they’re likely recovering costs from past regulatory approvals for infrastructure projects. Their service territory in northern Indiana might also face specific challenges, like higher maintenance costs or demand pressures, that aren’t as pronounced elsewhere. These elements together create a perfect storm for higher rates compared to peers like AES or AEP.

How are these rising utility costs impacting Indiana families and businesses, particularly those with limited financial flexibility?

The impact is profound, especially for low-income households and small businesses. A 17.5% or higher increase in electric bills can mean choosing between paying for utilities or other essentials like food or medical expenses. For businesses, higher energy costs eat into already thin margins, potentially leading to price hikes for customers or even layoffs. There’s also a ripple effect—when families struggle, local economies feel the pinch as spending tightens. It’s a real strain that amplifies calls for relief or assistance programs.

With AES Indiana seeking a rate increase of about 13.5% by 2027, on top of a 6% hike next year, do you expect significant opposition from residents or regulators?

Absolutely, there’s likely to be pushback. Residents are already reeling from recent hikes, and another double-digit increase will only fuel frustration. Advocacy groups like the Citizens Action Coalition will probably mobilize to challenge the proposal, arguing it’s unsustainable for ratepayers. Regulators at the IURC will be under pressure to scrutinize AES’s justification for the hike, especially with the governor’s focus on affordability. It could become a very public battle, with hearings drawing a lot of attention.

Shifting to the Indiana Utility Regulatory Commission, why do you think two commissioners chose to step down before their terms were up?

While they haven’t publicly explained their reasons, the timing raises eyebrows. It could be personal or professional decisions unrelated to current events, but it’s hard to ignore the context of heightened scrutiny on utility rates and the governor’s rhetoric. They might anticipate a more contentious regulatory environment and prefer to exit now. Alternatively, they could be responding to internal dynamics at the IURC or external pressures we’re not privy to. It’s speculative, but the departure at this juncture feels significant.

How might the departure of these commissioners affect ongoing decisions at the IURC, especially with major utility proposals in the pipeline?

It introduces uncertainty at a critical time. These commissioners were experienced voices on the panel, and their absence could slow down deliberations or shift the balance of perspectives on key issues like rate cases or NIPSCO’s generation proposal for data centers. While the IURC will still have a quorum to make decisions, new appointees might bring different priorities or need time to get up to speed. This could delay rulings or alter outcomes, which utilities and ratepayers alike will be watching closely.

What is your forecast for the future of utility rate regulation in Indiana, given the current political and economic pressures?

I think we’re heading into a period of heightened tension and transformation. Governor Braun’s focus on affordability will keep pressure on the IURC and utilities to justify every penny of rate increases, potentially leading to more innovative regulatory approaches or cost-sharing mechanisms. At the same time, the growing demand from data centers and industrial loads means utilities will need to invest heavily in capacity, which could clash with affordability goals. My forecast is a bumpy road ahead—expect more public battles over rates, but also some creative solutions as all sides grapple with balancing economic growth and consumer protection.