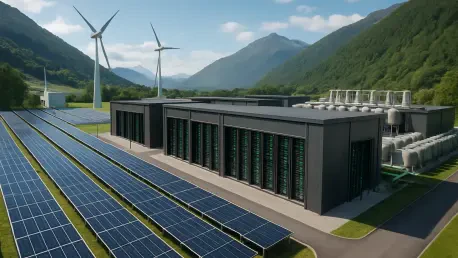

In an era where artificial intelligence (AI) is reshaping industries at an unprecedented pace, the backbone of this technological revolution—data centers—faces an escalating challenge: an insatiable demand for energy. As these hubs of computing power multiply to support AI’s complex algorithms and vast data processing needs, the strain on global energy resources intensifies, necessitating innovative and sustainable power solutions. Sungrow Power Supply Co. Ltd., a Hefei-based Chinese company, emerges as a pivotal player in this landscape, leveraging its unparalleled expertise in photovoltaic (PV) inverters and energy storage systems (ESS) to address the unique requirements of AI infrastructure. With a proven track record as a global leader in renewable energy, Sungrow is strategically positioning itself to fuel the digital future. This article delves into the company’s dominance in the renewable sector, its strategic shift toward energy storage, its tailored solutions for AI data centers, and the financial and market dynamics shaping its ambitious growth trajectory.

Leading the Charge in Renewable Energy

Sungrow has carved out a commanding presence in the renewable energy sector, boasting a 25.2% share of the global PV inverter market in 2024 and retaining its title as the world’s leading supplier for a decade. Operating in 170 countries, the company generated a substantial 58% of its revenue from international markets in the first half of the current year, reflecting its expansive and reliable global footprint. This widespread acceptance is not merely a testament to the quality of its products but also to its ability to adapt to diverse energy needs across different regions. Such a strong foundation provides Sungrow with the credibility and resources to tackle emerging challenges, particularly those driven by the rapid growth of AI technologies. The company’s established market position serves as a springboard for addressing the power demands of data centers, which are becoming critical to sustaining technological advancements in AI and beyond.

Beyond its impressive market share, Sungrow’s influence extends to shaping industry standards and expectations for renewable energy solutions. The company’s long-standing leadership in PV inverters has allowed it to build a robust network of partnerships and client trust, essential for navigating the complexities of international markets. This global reach is particularly significant as AI data centers require consistent and scalable power solutions, often spanning multiple geographies. Sungrow’s ability to deliver reliable equipment and services worldwide positions it uniquely to meet these needs, ensuring that energy supply keeps pace with the computational demands of modern technology. Moreover, its experience in diverse environmental and regulatory conditions equips Sungrow to customize solutions for specific regional challenges, further enhancing its relevance in the context of powering AI infrastructure on a global scale.

Pivoting to Energy Storage for Modern Demands

As competition in the PV inverter market tightens and profit margins shrink, Sungrow has astutely shifted its focus toward energy storage and power management solutions, aligning with evolving industry trends. In a significant milestone, the company’s ESS business surpassed PV inverter sales in the first half of the current year, contributing 41% of total revenue compared to 35.3% from inverters. This shift highlights a deliberate strategy to prioritize value-added services that address the complexities of contemporary energy challenges. By emphasizing energy storage, Sungrow is not just responding to market pressures but proactively positioning itself to support sectors with high power demands, such as AI data centers. This transition underscores the company’s foresight in recognizing where future growth lies and its commitment to staying ahead of the curve in a rapidly changing energy landscape.

The pivot to energy storage also reflects Sungrow’s understanding of the broader implications of renewable energy integration into modern grids. Data centers, especially those powering AI applications, require not only vast amounts of energy but also stability and reliability to prevent costly downtime. Sungrow’s ESS offerings are designed to store and dispatch energy efficiently, ensuring a steady power supply even during peak usage or grid fluctuations. This capability is crucial for maintaining the uninterrupted operation of AI systems, which often handle critical and time-sensitive processes. By investing heavily in storage technologies, Sungrow addresses a key bottleneck in the renewable energy sector, bridging the gap between generation and consumption. This strategic focus enhances the company’s relevance in supporting the digital economy, where energy reliability can make or break operational success.

Addressing the Power Hunger of AI Infrastructure

The exponential growth of AI technology is driving a staggering increase in energy consumption, with projections indicating a need for an additional 55 GW of power capacity worldwide by 2030 to support global computing demands. Sungrow is directly confronting this challenge by developing specialized products tailored to the rigorous requirements of AI data centers. Innovations like the PowerTitan 2.0 liquid-cooled ESS and the SG4800UD-MV-US modular inverter exemplify this targeted approach, offering over 93% energy efficiency and features such as rapid restart capabilities. These solutions are engineered to handle the intense, continuous power needs of AI infrastructure, ensuring that data centers can operate at peak performance without energy-related interruptions. Sungrow’s commitment to this niche demonstrates its role as a forward-thinking leader in the intersection of renewable energy and cutting-edge technology.

Furthermore, the design of Sungrow’s products for AI data centers goes beyond mere energy provision to incorporate advanced power management features. The ability to quickly adapt to fluctuating demands and maintain high efficiency under varying conditions is paramount for facilities that run complex AI models around the clock. These tailored solutions not only reduce operational costs for data center operators by optimizing energy use but also contribute to sustainability goals by maximizing the integration of renewable sources. Sungrow’s focus on high-performance systems addresses the dual need for reliability and environmental responsibility, a balance that is increasingly critical as the tech industry faces scrutiny over its carbon footprint. By aligning its innovations with the specific needs of AI infrastructure, Sungrow is helping to shape a future where technology and sustainability coexist seamlessly.

Financial Performance and Expansion Hurdles

Sungrow’s financial trajectory reflects impressive growth, with revenue climbing from 40.11 billion yuan in 2022 to 77.7 billion yuan in 2024, alongside a 40% year-over-year increase in the first half of the current year. Gross margins have also seen a notable rise, reaching 32.9%, indicative of improved operational efficiency and a successful shift to higher-value products. This financial strength showcases Sungrow’s ability to scale operations and invest in innovation despite a competitive market. However, challenges persist, particularly with working capital, as accounts receivable remain high and net operating cash inflows have declined. These pressures highlight the significant costs associated with research, development, and global expansion efforts, especially as the company ramps up to meet the surging energy demands of AI-driven industries. Balancing growth with financial stability remains a critical focus.

In addition to revenue gains, market perception of Sungrow’s potential is evident in its stock performance, which saw a 120% year-to-date increase on the Shenzhen exchange. Yet, this optimism comes with caveats, as the company’s forward price-to-earnings ratio stands at a lofty 24.3 times, far exceeding that of some Hong Kong-listed peers. This valuation disparity raises questions about the reception of its planned secondary listing in Hong Kong, intended to fund further innovation and international growth. While investor confidence signals strong belief in Sungrow’s long-term prospects, the financial strain of heavy investments in cutting-edge technology and overseas facilities cannot be ignored. Navigating these fiscal challenges will be crucial for sustaining momentum, especially as the company aims to capitalize on the growing intersection of renewable energy and AI technology in a highly competitive global arena.

Strategic Moves for Sustained Growth

To support its ambitious expansion, Sungrow is pursuing a secondary listing in Hong Kong, with the proceeds earmarked for developing next-generation PV and ESS products and establishing overseas production capabilities. This move is designed to bolster the company’s capacity to meet anticipated global demand, particularly in the AI energy sector, where rapid scalability is essential. By enhancing its manufacturing footprint internationally, Sungrow aims to reduce logistical costs and improve responsiveness to regional markets, a critical factor in maintaining competitiveness. The strategic focus on next-generation technologies also ensures that the company remains at the forefront of innovation, ready to address evolving energy needs with cutting-edge solutions. This forward-looking approach positions Sungrow to seize opportunities in a market poised for exponential growth over the coming years.

Investor sentiment, while largely positive as reflected in the significant stock price surge, remains tempered by valuation concerns surrounding the upcoming Hong Kong IPO. The funds raised are expected to alleviate some of the working capital constraints currently faced, enabling Sungrow to accelerate product development tailored for AI infrastructure. Beyond financial reinforcement, the listing represents a broader commitment to global expansion and market diversification, key pillars for long-term resilience in a dynamic industry. As the electrification of computing power continues to reshape energy markets, Sungrow’s proactive steps to align its resources and strategy with this trend highlight its potential to lead in this transformative space. Looking ahead, the company’s efforts to balance immediate financial pressures with visionary investments lay a strong foundation for navigating the future of energy solutions for AI and beyond.