Setting the Stage: A Critical Juncture for Energy Markets

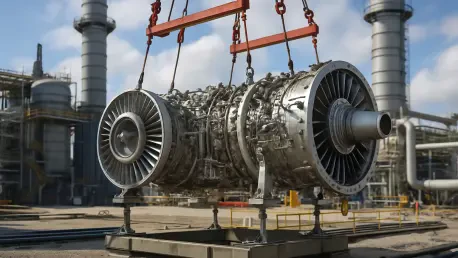

In an era where energy consumption is skyrocketing due to booming data centers and population growth, Georgia Power stands at a pivotal moment in the energy sector, facing unprecedented challenges. The utility’s recent acquisition of a natural gas turbine for Plant Yates—its first in over a decade—signals a strategic response to mounting pressures on the grid. With demand for reliable power surging and supply chain bottlenecks threatening timely infrastructure deployment, the role of gas turbines has never been more critical. This analysis dives into the market dynamics shaping Georgia Power’s reliance on these technologies, examining current trends, future projections, and the broader implications for the energy landscape. The focus is on understanding how these turbines address immediate needs while positioning the utility for long-term stability in a rapidly evolving market.

Market Dynamics: Trends and Challenges in Gas Turbine Deployment

Surging Demand and the Shift to Flexible Power Solutions

The energy market is undergoing a profound transformation as utilities grapple with the dual challenge of meeting escalating power needs and integrating renewable sources. Georgia Power’s strategic move to secure three Mitsubishi Power M501JAC simple-cycle turbines, with a combined capacity of 1.3 GW, highlights a broader trend toward dispatchable power sources. These turbines, slated to come online between December 2026 and late 2027, are designed to provide peaking power during high-demand periods and support grid stability as solar and wind resources face intermittency issues. Industry data indicates that the flexibility of gas turbines is indispensable, especially in regions like the Southeast, where industrial growth and data center expansion are driving unprecedented energy consumption.

Beyond flexibility, the market is witnessing a shift in fuel adaptability as a key consideration. The ability of these advanced turbines to switch to oil as a backup fuel, albeit at a reduced capacity of 1 GW to 1.1 GW, offers a safeguard against supply disruptions. Additionally, potential compatibility with hydrogen fuel mixes through minor modifications points to a forward-looking approach in an industry increasingly focused on reducing carbon footprints. This adaptability underscores why gas turbines are not merely a temporary fix but a vital component of the energy mix in a transitional market.

Supply Chain Bottlenecks: A Growing Barrier to Growth

A significant hurdle in the gas turbine market is the extended lead times for equipment delivery, a challenge that has intensified in recent years. Industry insights reveal that timelines for large turbines have stretched from a previous average of two and a half years to as long as five to seven years due to heightened demand and production constraints. This surge in demand stems from multiple factors, including the retirement of coal plants, the need for backup power for renewables, and the rapid proliferation of data centers requiring hundreds of megawatts of consistent energy. Georgia Power’s proactive ordering of turbines ahead of current backlogs exemplifies strategic foresight, but many utilities and developers are not as fortunate.

To navigate these delays, a notable trend is the rising preference for smaller gas turbines, which offer shorter lead times of two to three years. These units are gaining traction, particularly for data center projects, as developers prioritize speed over scale to meet urgent power needs. However, questions linger about whether smaller turbines can match the efficiency and capacity of larger models, highlighting a tension between immediacy and long-term value in the market. This dynamic suggests that diversified procurement strategies will be essential for stakeholders aiming to balance timelines with performance.

Workforce and Production Constraints Impacting Scalability

Compounding supply chain issues are significant workforce shortages and production challenges within the gas turbine sector. The complexity of manufacturing large turbines, which require vast material inputs and expansive assembly spaces, is exacerbated by a lack of skilled labor in engineering, procurement, and construction fields. Reports indicate that some companies face hundreds of unfilled positions, slowing down the pace of new installations. This bottleneck not only delays projects but also drives up costs, creating a ripple effect across the energy market.

In response, innovative solutions are emerging to mitigate reliance on new turbine production. Efforts to extend the lifespan of existing assets and upgrade installed units for enhanced efficiency are gaining attention as viable alternatives. Such strategies could reduce the immediate need for new equipment, offering a buffer against supply chain disruptions. For utilities like Georgia Power, these approaches may provide a competitive edge, allowing for sustained grid reliability without the burden of prolonged delays.

Future Projections: Evolving Role of Gas Turbines in Energy Markets

Hydrogen Integration and Sustainability Goals

Looking ahead, the gas turbine market is poised for evolution as sustainability becomes a central focus. The potential for turbines to operate with hydrogen blends or transition entirely to cleaner fuels is a promising development that aligns with broader decarbonization objectives. While natural gas remains the dominant fuel for dispatchable power, the adaptability of modern turbines to alternative energy sources signals a pathway toward reducing emissions without sacrificing reliability. This trend could reshape market priorities, with manufacturers and utilities investing in technologies that bridge current needs with future environmental mandates.

Economic and regulatory factors will also play a defining role in shaping the trajectory of gas turbine deployment. Federal incentives for clean energy and potential shifts in emissions standards may accelerate the adoption of hydrogen-ready infrastructure. For Georgia Power, staying ahead of these changes through early adoption of versatile technologies could solidify its position as a market leader. The interplay between innovation and policy will likely determine how quickly the industry pivots toward sustainable practices over the next few years.

Balancing Immediate Needs with Long-Term Storage Solutions

Another critical projection is the evolving relationship between gas turbines and emerging energy storage technologies. While turbines currently serve as a backbone for grid stability, advancements in battery storage and other systems are expected to reduce dependence on fossil fuel-based peaking power over time. Market analysts anticipate that by the period from now to 2027, storage solutions will become more cost-effective and scalable, potentially altering the role of gas turbines from primary backup to complementary assets. This shift could redefine investment priorities, with utilities allocating resources to hybrid systems that integrate renewables, storage, and turbines.

Despite these advancements, gas turbines are unlikely to be phased out in the near term due to their proven reliability and capacity to handle sudden demand spikes. The challenge for market players will be to strategically time investments in both turbine infrastructure and storage technologies to optimize costs and performance. For regions with high data center concentrations like Georgia, maintaining a robust turbine fleet will remain a priority to ensure uninterrupted power supply during the transition to more integrated energy systems.

Reflecting on the Path Forward: Strategic Insights for Energy Stakeholders

Looking back, the analysis of Georgia Power’s reliance on gas turbines revealed a market at a crossroads, balancing immediate reliability with long-term sustainability. The utility’s timely acquisition of high-capacity turbines underscored a proactive stance against supply chain delays, while emerging trends like smaller units and hydrogen compatibility pointed to a diversifying energy landscape. The challenges of workforce shortages and extended lead times stood out as persistent barriers that demanded innovative responses.

For stakeholders, several actionable steps emerged from this examination. Utilities and developers were encouraged to prioritize early procurement and explore partnerships with manufacturers to secure equipment ahead of backlogs. Investing in workforce development and upgrading existing turbine assets offered practical solutions to mitigate delays. Additionally, a focus on hybrid systems combining turbines with storage and renewables provided a forward-thinking approach to grid resilience. These strategies, inspired by Georgia Power’s example, paved the way for navigating the complexities of modern energy demands while fostering a stable and adaptable power infrastructure for the future.