In a stunning development that has sent shockwaves through the clean energy sector, the U.S. Department of Energy (DOE) has pulled the plug on over $700 million in grants earmarked for battery and manufacturing projects, a decision that could reshape the trajectory of domestic energy innovation and impact future advancements. Announced on October 21, this move affects prominent companies like Ascend Elements, American Battery Technology, and ICL Specialty Products, raising pressing questions about the future of federal support for critical technologies. The DOE points to missed milestones and insufficient economic viability as the driving forces behind the cancellation, signaling a hardened stance on how taxpayer dollars are allocated in the pursuit of energy goals. As part of a broader pattern of funding cuts, this action reflects a strategic pivot toward fiscal accountability, but at what cost to advancements in battery technology and energy independence? This unfolding situation demands a closer look at the rationale, the immediate impacts, and the long-term implications for the industry.

Understanding the DOE’s Decision

Scrutiny Over Project Performance

The DOE’s justification for slashing over $700 million in grants hinges on a rigorous evaluation of project outcomes, with a clear emphasis on ensuring that federal investments deliver measurable results for the public. Officials have highlighted that the canceled projects, spanning battery development and manufacturing, failed to hit critical benchmarks or prove their economic sustainability. This approach underscores a broader mandate to prioritize initiatives that can demonstrably contribute to national energy security or economic growth. For instance, the DOE argues that continuing to fund underperforming projects risks squandering taxpayer resources without advancing strategic objectives. Such a stance suggests a departure from more lenient funding policies of the past, placing pressure on grant recipients to justify their progress with concrete data. This shift could redefine expectations for future clean energy endeavors, compelling companies to align more closely with federal priorities or risk losing support.

Beyond the immediate reasoning, this cancellation fits into a larger narrative of fiscal responsibility that the DOE appears to be championing across its portfolio. The decision to pull funding is not merely about individual project failures but reflects a systemic effort to reassess how public money is deployed in high-stakes sectors like energy innovation. By focusing on economic viability, the DOE aims to ensure that each dollar spent yields a return, whether through job creation, technological breakthroughs, or reduced reliance on foreign supply chains. However, this stringent criterion raises concerns about whether promising but complex projects might be prematurely abandoned due to short-term performance hiccups. Balancing innovation with accountability remains a delicate task, and the DOE’s current approach may set a precedent for how future grants are evaluated, potentially narrowing the scope of what qualifies for federal backing in the clean energy space.

Context of Broader Funding Reductions

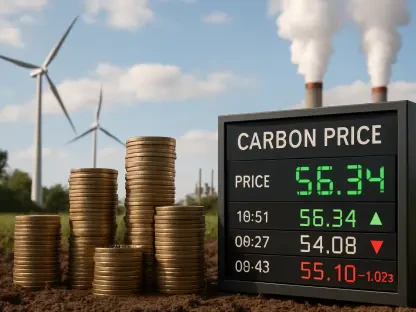

The $700 million cut is far from an isolated incident, as it aligns with a series of substantial funding rollbacks by the DOE, totaling billions across various clean energy and decarbonization programs. Earlier actions include the termination of $7.6 billion for 321 clean energy projects and $3.7 billion for carbon capture initiatives, pointing to a consistent policy of reevaluating investments for their strategic and financial worth. This pattern suggests that the DOE is undertaking a sweeping audit of its commitments, with hundreds of projects worth $23 billion still under review for potential cancellation. Such widespread scrutiny indicates a cautious approach to federal spending, prioritizing initiatives that can prove their impact over those with uncertain or delayed outcomes. The ripple effects of these decisions could slow progress in critical areas like renewable energy deployment, even as they aim to safeguard public funds from inefficient use.

Moreover, the scale of these reductions highlights a tension between ambitious national energy goals and the practical challenges of funding large-scale innovation. While the DOE’s intent to maximize returns on investment is evident, the risk of stifling emerging technologies looms large, especially in sectors like battery manufacturing that are vital for reducing dependence on imported materials. The ongoing review of major programs, such as the Regional Clean Hydrogen Hubs, further underscores the uncertainty facing the industry, as stakeholders await clarity on which initiatives will survive the cut. This broader context of funding recalibration paints the $700 million cancellation as a symptom of a larger policy shift, one that could reshape the landscape of clean energy development for years to come. As the DOE tightens its criteria, the challenge lies in ensuring that fiscal conservatism does not come at the expense of long-term sustainability objectives.

Implications for Industry and Policy

Challenges for Affected Companies

The fallout from the DOE’s decision to cancel over $700 million in grants has hit companies with varying degrees of severity, casting uncertainty over projects pivotal to domestic battery production. For ICL Specialty Products, the loss of a $197 million grant jeopardizes a $500 million battery plant in St. Louis, a development that promised to boost local manufacturing and create jobs. The company has acknowledged escalating costs as a contributing factor to the DOE’s decision, reflecting the broader difficulty of managing budgets in ambitious energy projects amid economic pressures. This setback could delay or even derail the initiative, potentially undermining regional economic growth and the push for advanced battery technologies. The situation illustrates how dependent some companies are on federal support to navigate the high costs and technical hurdles of scaling up operations in a competitive market.

In contrast, American Battery Technology demonstrates a more resilient response to the funding cut, despite losing a $57.7 million grant for a $2 billion lithium mine and refinery project in Nevada. CEO Ryan Melsert has publicly committed to moving forward independently, emphasizing the project’s importance to securing domestic supply chains for battery materials. This determination highlights a significant divergence in how companies cope with federal funding volatility, with some viewing grants as supplementary rather than essential to their plans. However, proceeding without DOE support may still pose financial and logistical challenges, potentially slowing the timeline for a project critical to reducing reliance on foreign lithium sources. The varied responses among affected firms reveal a complex landscape where resilience and vulnerability coexist, shaped by each company’s resources and strategic priorities in the face of unexpected setbacks.

Shifts in Federal Energy Strategy

A clear trend emerging from the DOE’s actions is a move toward stricter criteria for clean energy investments, prioritizing fiscal accountability over expansive but risky ventures. The cancellation of over $700 million in grants is just one piece of a larger puzzle, as evidenced by prior cuts of $7.6 billion for clean energy projects and $3.7 billion for carbon capture efforts. This consistent focus on financial viability and measurable progress suggests that the DOE is adopting a more conservative stance on energy spending, aiming to ensure that taxpayer funds are directed toward initiatives with proven potential. While this approach may enhance efficiency and accountability, it also risks sidelining projects that require longer timelines or face initial hurdles but could yield significant long-term benefits. The balance between immediate returns and future innovation remains a central tension in this evolving policy framework.

Adding another layer of complexity to the DOE’s funding decisions is the apparent correlation between some cuts and regional or political demographics, though no concrete evidence confirms such motivations. Notably, the $7.6 billion cancellation targeted projects in states that supported Vice President Kamala Harris in the 2024 election, prompting speculation about whether electoral outcomes influence federal allocations. The DOE maintains that economic and performance metrics are the sole drivers of these decisions, emphasizing missed milestones and poor returns on investment as universal justifications. Nevertheless, this pattern introduces a nuanced dimension to the discussion, raising questions about the intersection of policy and politics in shaping energy funding. Until further clarity emerges, the focus remains on the DOE’s stated commitment to strategic alignment and fiscal responsibility, which will likely continue to guide future grant evaluations.

Looking Ahead to Energy Funding Challenges

Reflecting on the DOE’s cancellation of over $700 million in grants for battery and manufacturing projects, it’s evident that this decision marked a pivotal moment in the trajectory of U.S. energy policy. The emphasis on economic viability and strategic impact drove a reevaluation that left several high-profile initiatives in limbo, challenging companies to adapt under tightened federal oversight. As the dust settled, the varied responses from affected firms underscored the resilience of some and the vulnerability of others, painting a picture of an industry at a crossroads. Moving forward, stakeholders must navigate this new landscape by exploring alternative funding sources, forging private partnerships, or refining project scopes to meet stricter DOE standards. Additionally, policymakers face the task of balancing fiscal caution with the urgent need for innovation in clean energy, ensuring that critical advancements in battery technology and sustainability are not indefinitely delayed. This evolving dynamic calls for a collaborative approach to redefine how public investments can effectively fuel the nation’s energy future.