Setting the Stage: A Renewable Energy Project at a Crossroads

Imagine a sprawling 800-megawatt offshore wind farm poised to power hundreds of thousands of homes, yet teetering on the brink of collapse due to political opposition and local unrest. This is the reality for Vineyard Wind 1, a flagship project off the coast of Nantucket, Massachusetts, now caught in a storm of controversy. As a cornerstone of America’s renewable energy ambitions, its fate could signal the future trajectory of the offshore wind market. This market analysis delves into the economic, political, and community dynamics threatening the project, assessing current trends and forecasting potential outcomes for the industry. The importance of this examination lies in understanding whether offshore wind can withstand mounting challenges or if policy shifts will reshape energy investments in the years ahead.

Market Dynamics: Trends, Challenges, and Projections in Offshore Wind

Political Pressures: A Hostile Policy Landscape Emerges

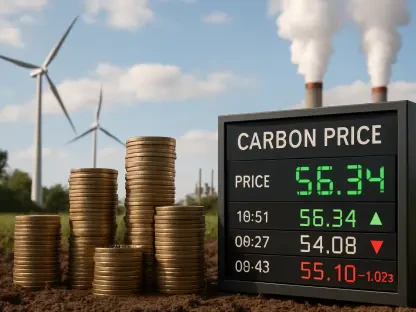

The offshore wind sector faces unprecedented political resistance, particularly with a federal administration openly critical of the industry. Directives to scrutinize existing leases and eliminate future offshore wind energy areas signal a sharp pivot away from renewable energy support. A prominent conservative think tank has petitioned multiple federal agencies to revoke Vineyard Wind 1’s permits, citing procedural flaws from prior approvals. This aligns with a broader policy stance that views wind turbines as economically unviable and visually intrusive, creating a chilling effect on investor confidence. Market data reflects this uncertainty, with a slowdown in new lease auctions since the shift in federal priorities, suggesting a potential contraction in project pipelines over the next few years.

Beyond immediate policy actions, the ripple effects on market sentiment are profound. Developers now grapple with the risk of permit revocations, which could deter long-term capital commitments. Projections indicate that if current trends persist, the growth of offshore wind capacity might stall, with planned projects between now and 2027 facing delays or cancellations. This political headwind not only impacts Vineyard Wind 1 but also sets a precedent for how federal authority might override state-level renewable goals, reshaping the competitive landscape for clean energy investments.

Environmental Risks: Incidents Undermine Industry Credibility

Environmental concerns add another layer of complexity to the offshore wind market, with high-profile mishaps fueling skepticism. A notable turbine blade failure at Vineyard Wind 1, resulting in debris littering Nantucket beaches, has become a focal point for critics. While the manufacturer settled with the local community for millions, the incident exposed vulnerabilities in infrastructure reliability and regulatory oversight. Such events erode public trust, a critical factor for market acceptance, and highlight the need for stringent safety standards as the industry scales up.

Market analysis suggests that environmental risks could increase operational costs, as developers may need to invest in advanced technologies and contingency funds to mitigate future failures. Forecasts for the sector indicate a growing demand for robust risk management frameworks, with insurers potentially raising premiums for offshore projects. If unaddressed, these challenges could slow project timelines and inflate budgets, making offshore wind less competitive against other energy sources in the near term. The industry must balance innovation with accountability to maintain momentum amidst these setbacks.

Community Resistance: Local Pushback as a Market Barrier

Local opposition, particularly from communities like Nantucket, represents a significant market barrier for offshore wind. Residents and town officials have expressed frustration over visual impacts, such as turbine warning lights, and perceived inadequate responses during environmental incidents. Despite mitigation efforts like installing systems to reduce light pollution, tensions persist, with demands for financial safeguards and better communication from developers. This grassroots resistance underscores a critical market trend: the necessity of community buy-in for project success.

From a market perspective, persistent local conflicts can delay projects and escalate costs through litigation or renegotiated agreements. Analysis of current patterns shows that regions with strong community opposition often see reduced project viability, impacting investor interest. Looking ahead, the industry might need to allocate greater resources toward stakeholder engagement, potentially reshaping project budgets. If these social license challenges are not addressed, the offshore wind market risks alienating key demographics, limiting expansion in coastal areas primed for development.

Economic and Technological Outlook: Navigating a Turbulent Future

Economically, the offshore wind sector faces rising costs due to supply chain disruptions and technological hurdles, compounded by political and social barriers. Data indicates that project expenses have increased in recent years, driven by inflation and the need for specialized equipment. Vineyard Wind 1 exemplifies these pressures, with additional expenditures likely required to meet community demands and withstand legal challenges. Market projections suggest that without significant cost reductions or federal incentives, profitability margins could shrink, deterring new entrants.

Technologically, the industry must innovate to overcome reliability issues and enhance efficiency. Advances in turbine design and monitoring systems are critical to preventing incidents like blade failures, which damage both reputation and finances. Forecasts for the next few years anticipate a push toward modular and resilient infrastructure, though development cycles for such solutions remain lengthy. The interplay of economic constraints and technological needs will likely define the market’s trajectory, testing the sector’s ability to adapt under adverse conditions.

Reflecting on the Path Forward: Strategic Insights from a Contested Market

Looking back, the analysis of Vineyard Wind 1 and the broader offshore wind market reveals a sector at a pivotal moment, grappling with political hostility, environmental scrutiny, and local discontent. The findings underscore how federal policy shifts create uncertainty, while incidents and community resistance amplify operational risks. Economic and technological challenges further complicate the landscape, highlighting a market strained by external and internal pressures.

Moving ahead, stakeholders need to adopt strategic measures to navigate this turbulence. Developers should prioritize transparent dialogue with communities, integrating local feedback into project planning to build trust. Policymakers could play a role by establishing clear, balanced regulations that address safety concerns without stifling innovation. For investors, diversifying portfolios to hedge against policy risks becomes essential, while industry leaders must champion technological advancements to bolster reliability. These steps, though challenging, offer a roadmap to stabilize the market, ensuring that renewable energy ambitions do not falter under the weight of opposition.