A Landmark Settlement Reshaping America’s Energy Landscape

In a decision poised to create the largest wholesale power provider in the United States, the Department of Justice has officially cleared Constellation Energy’s $26.6 billion acquisition of Calpine, though the approval is the result of a landmark antitrust settlement that addresses significant regulatory concerns over market competition. This article dissects the intricacies of this historic deal, exploring the government’s initial objections, the specific terms of the negotiated divestiture, and the far-reaching implications for an industry undergoing profound transformation. Ultimately, this analysis illuminates how the settlement navigates the delicate balance between enabling massive corporate consolidation and protecting millions of American consumers from potential price hikes.

The Rising Stakes of Consolidation in U.S. Power Markets

The Constellation-Calpine merger did not materialize in a vacuum. It represents a culminating point in a long-running trend of consolidation within the American energy sector, where scale is increasingly seen as a prerequisite for survival and success. As the nation’s power grids grapple with the transition to cleaner energy sources and the demand for greater reliability, major players have sought to expand their generation portfolios. This backdrop is crucial for understanding the intense regulatory scrutiny the deal attracted. The federal government, after a long period of relative quiet on electricity mergers, has shown renewed vigor in antitrust enforcement, making this case a bellwether for future transactions. The fact that this settlement marks the DOJ antitrust division’s first such action in the electricity sector in 14 years signals a significant policy shift, making the resolution of this case a critical precedent.

Navigating the Gauntlet of Regulatory Scrutiny

Dissecting the Government’s Antitrust Complaint

The core of the government’s challenge, filed jointly by the DOJ and the state of Texas, was a potent concern over market power. Regulators argued that an unfettered merger would grant the new, larger Constellation the ability to dominate key wholesale electricity markets, specifically the Electric Reliability Council of Texas (ERCOT) and the Mid-Atlantic region of the PJM Interconnection. The complaint detailed a scenario where the combined entity could strategically withhold electricity supply to artificially create scarcity and drive up prices. Officials voiced the fear directly, noting that Americans deserve the benefit of robust competition among electricity generators when it comes to their utility bills. The DOJ estimated that without intervention, the merger could inflate electricity costs for consumers by over $100 million annually, a direct threat to household and business budgets.

The Anatomy of a Precedent-Setting Divestiture

To resolve these antitrust concerns, Constellation agreed to a carefully structured divestiture plan. This settlement builds upon an earlier mandate from the Federal Energy Regulatory Commission (FERC), which had already required the sale of four power plants totaling nearly 3,550 MW in the PJM market. The DOJ’s consent decree added three more critical assets to the list: Calpine’s 828-MW York 2 Energy Center in Pennsylvania, its 609-MW Jack A. Fusco Energy Center near Houston, and a 19-MW stake in the Gregory Power Plant near Corpus Christi. By forcing the sale of these modern, gas-fired plants in strategically vital locations, regulators aim to ensure that sufficient competition remains in these sensitive markets. Constellation now has 240 days post-acquisition to finalize the sale of these assets, a condition that directly addresses the market concentration risks identified in the complaint.

The Birth of a New Energy Behemoth

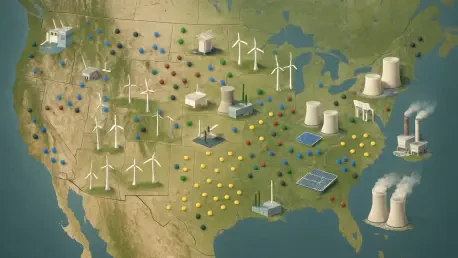

Even with the mandated divestitures, the scale of the newly formed Constellation Energy is staggering. The acquisition transforms the company into the undisputed leader in the U.S. wholesale power market, commanding a diverse generating portfolio of approximately 55 gigawatts. This capacity spans the full spectrum of energy sources, including a formidable fleet of nuclear and natural gas plants alongside growing assets in geothermal, hydroelectric, wind, and solar power. Considering Calpine alone contributed 27 GW of generating assets to the deal, the final portfolio underscores the immense scale of this consolidation. The settlement, therefore, achieves a dual objective: it allows for the creation of an industry titan capable of navigating the complex energy transition while imposing guardrails intended to preserve market integrity.

The Future of Energy Mergers in an Era of Renewed Oversight

This landmark settlement is more than just a resolution for a single deal; it signals a new chapter in federal oversight of the energy industry. Coming just days after the U.S. Solicitor General advised the Supreme Court to reject a separate antitrust appeal from Duke Energy, the DOJ’s assertive stance suggests that future megamergers will face a much higher bar for approval. The multi-layered review process—which saw the Constellation-Calpine deal challenged by ratepayer advocates before facing conditional approvals from both FERC and the DOJ—is likely to become the new standard. Energy companies contemplating similar strategic combinations must now anticipate a rigorous, data-driven analysis of their market impact and be prepared to negotiate significant asset divestitures to satisfy regulators focused on consumer protection.

Key Takeaways and Strategic Implications

The primary takeaway from this lengthy regulatory process is that while large-scale consolidation in the energy sector is still possible, it comes with significant strings attached. The settlement reinforces the use of surgical divestitures as the government’s preferred tool for mitigating anti-competitive harms without blocking deals outright. For industry stakeholders, the message is clear: any proposed merger that concentrates generation assets in key markets will be meticulously examined. Companies must proactively identify potential antitrust red flags and prepare a compelling case, likely including a pre-packaged divestiture plan, to demonstrate that their transaction will not harm consumers. For investors and market analysts, this signals a more complex and prolonged approval timeline for future deals, introducing a new layer of regulatory risk into strategic planning.

A New Precedent for Power and Competition

The DOJ’s conditional approval of the Constellation-Calpine acquisition is a pivotal moment for the U.S. energy market. It simultaneously permits the formation of an unprecedented power generation giant while reasserting the federal government’s role as a guardian of market competition. The core theme throughout this saga has been the inherent tension between the pursuit of corporate scale and the imperative of protecting consumers. By enforcing a substantial divestiture of key assets, regulators drew a clear line in the sand, establishing a powerful precedent that undoubtedly shaped the structure and regulation of the American electricity industry for years to come. This case stood as a critical reference point for how the nation balanced the evolution of its energy giants with the economic well-being of its citizens.