Setting the Stage for Energy Market Dynamics

In a landscape where electricity demand surges relentlessly across the U.S., the Federal Energy Regulatory Commission (FERC) has delivered a pivotal decision on the Southwest Power Pool (SPP), a key player managing the grid across 14 states from eastern New Mexico to parts of Montana. This ruling, blending approval and rejection of critical proposals, arrives at a juncture when aging power plants are retiring faster than replacements come online, threatening resource adequacy. The significance of this moment cannot be overstated, as it shapes not just SPP’s operational strategy but also the broader market’s approach to balancing urgency with regulatory fairness. This analysis dives into the implications of FERC’s mixed verdict, exploring how it influences energy market trends, grid reliability investments, and future capacity planning.

Unpacking Market Trends and Capacity Challenges

The Growing Strain on SPP’s Energy Infrastructure

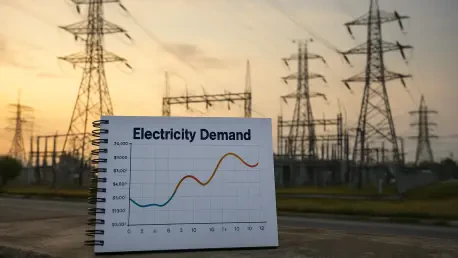

The energy market within SPP’s region is under immense pressure, driven by population growth, industrial expansion, and increasing electrification of sectors like transportation. Over recent years, the rapid retirement of coal and older natural gas facilities has left a gap that intermittent renewable sources struggle to fill consistently. This mismatch between supply and demand has created a looming risk of shortages, pushing SPP to seek innovative solutions for capacity expansion. The market’s response to these dynamics is critical, as investors and operators alike grapple with the need for swift action amid tightening regulatory oversight. Understanding this backdrop reveals why FERC’s decisions are a linchpin for market stability in the near term.

FERC’s Approval: A Boost for Targeted Expansion

Delving into the specifics, FERC’s green light for SPP’s proposal to allow a 20% capacity expansion at existing facilities marks a significant win for the market. This temporary priority review process, active from late 2025 to early 2026 (pending further approvals), targets projects ready to break ground with secured financing and equipment delivery timelines. Such a mechanism promises to inject much-needed capacity into the grid within a five-year window, offering a lifeline to strained markets. Clean energy advocates have hailed this as a balanced approach, fostering growth without skewing competitive dynamics. However, the market must watch closely to ensure that infrastructure can handle this accelerated integration without unforeseen bottlenecks.

Rejections Signal Market Fairness Over Speed

On the flip side, FERC’s rejection of two broader SPP proposals underscores a market trend toward equity over haste. The first denial addressed a plan to extend priority reviews to sites of recently retired plants, citing vague capacity limits as a sticking point. The second rebuff concerned granting queue priority for interconnection studies, which FERC deemed unsupported by solid evidence. These decisions reflect a cautious market sentiment, prioritizing transparent rules over rapid but potentially unfair expansions. For investors, this suggests a need to focus on well-defined projects, as regulators seem unlikely to endorse sweeping reforms without rigorous justification. This balance could temper short-term growth but strengthen long-term market integrity.

Market Projections: Navigating Regulatory and Technological Shifts

Looking ahead, the energy market in SPP’s domain and beyond is poised for transformation, shaped by FERC’s nuanced stance. Grid operators are likely to refine their strategies, presenting proposals with detailed impact analyses to meet regulatory standards, which could slow but solidify capacity additions. Technological advancements, such as grid-scale battery storage and enhanced transmission systems, are expected to play a larger role, offering complementary solutions to traditional expansion. Moreover, as regulatory frameworks evolve, market participants anticipate tighter interconnection rules that still aim for efficiency, potentially reshaping investment priorities. From 2025 to 2027, expect a surge in funding toward projects meeting strict criteria, alongside a push for innovation to address persistent capacity gaps.

Reflecting on Market Implications and Strategic Pathways

Looking back, FERC’s mixed rulings on SPP’s proposals painted a complex picture for the energy market, blending immediate relief with a firm reminder of regulatory boundaries. The approval of limited expansions at existing facilities provided a crucial boost to capacity, addressing urgent market needs. Conversely, the rejections of broader initiatives highlighted the importance of clarity and fairness, guiding market behavior toward precision in planning. For stakeholders, the path forward involved aligning investments with stringent project requirements, ensuring readiness for fast-track opportunities. Additionally, exploring partnerships for transmission upgrades and energy storage emerged as vital steps to support sustainable growth, offering a roadmap for navigating the evolving landscape of grid reliability and market competition.