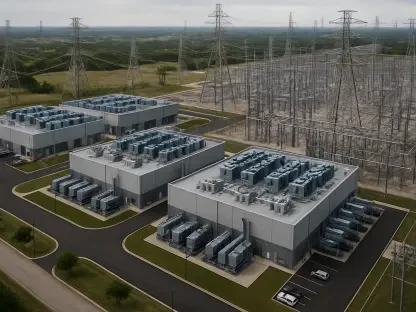

With the PJM Interconnection, the nation’s largest grid operator, recently approving a monumental $11.8 billion transmission expansion, we are witnessing one of the most significant proactive investments in grid reliability in recent memory. To unpack what this means for the industry and consumers, we’re joined by Christopher Hailstone, a leading expert in energy management and electricity delivery. We will explore the critical reliability risks this plan aims to solve, the financial implications for ratepayers, the intricate technical challenges of these new projects, and the complex decision-making process that balances cost against long-term grid security.

PJM’s latest plan addresses strained grid reliability from accelerated load growth and new generation. Could you walk through the specific reliability risks being mitigated with this massive investment and explain why a proactive, long-term approach is critical, even with extended construction timelines?

We’re facing a convergence of pressures that the existing grid was simply not designed to handle. You have this accelerated load growth spreading across both the Mid-Atlantic and Midwest, which is putting a tremendous strain on the system. On top of that, we’re trying to connect new generation sources in southern Virginia while simultaneously planning for future power plants in the western part of PJM’s territory. When you factor in delays to major projects like New Jersey’s offshore wind and a general increase in power flowing eastward, you can see why the system is stressed. This is precisely why a proactive plan is non-negotiable. Siting, permitting, and building major transmission lines is an incredibly lengthy process; we’re talking about projects slated for 2031 and 2032. If PJM waited until the problems were dire, they would be introducing immense reliability risks and development roadblocks. It’s far better to build for the grid you know you’ll need in a decade than to react when it’s already too late.

With transmission’s share of wholesale power costs rising to 32% in 2024, how might this $11.8 billion expansion impact consumer bills? Please elaborate on the cost-sharing mechanisms across PJM’s footprint and how they are designed to manage the financial burden on ratepayers.

There’s no way around it; an investment of this magnitude will have an impact. We’ve already seen transmission costs climb, making up $13.9 billion, or nearly a third, of total wholesale power costs in 2024. However, the cost of not making these investments—in terms of blackouts, economic disruption, and emergency repairs—would be far greater. The key to managing the financial burden is the cost-sharing mechanism. For these large, multi-zone projects, like the massive Dominion line in Virginia, the costs are not shouldered by a single state or utility. Instead, they are socialized across the entire PJM footprint. This spreads the financial impact over a much larger base of customers, making it more manageable for everyone and reflecting the fact that a stronger, more reliable grid benefits the entire region, not just the area where the wire is physically located.

Dominion Energy plans a multi-billion-dollar project to deliver 3,000 MW to data centers in Loudoun County. Can you detail the unique technical challenges of building a high-voltage underground line with DC converters and explain why such a dedicated project is essential for this specific load center?

This Dominion project is a fascinating piece of modern grid engineering, born out of necessity. Loudoun County is the largest data center hub in the world, and that creates an incredible, concentrated demand for power—we’re talking about needing to deliver 3,000 MW. Building a traditional overhead line through such a developed area is often impossible. The solution here is a 525-kV underground line, which presents immense challenges in terms of heat dissipation, construction logistics, and cost. Furthermore, to move that much power efficiently over 185 miles, they’re using high-voltage direct current (HVDC) technology. This requires building two massive converter stations, one at each end, to change the power from AC to DC and then back again. This isn’t just a simple wire; it’s a dedicated, high-capacity energy highway being built specifically to keep this critical economic engine running without destabilizing the rest of the regional grid.

The $1.7 billion NextEra/Exelon project in Pennsylvania was opposed over concerns about less expensive alternatives. What criteria does PJM use to evaluate competing proposals, and how does it balance immediate cost concerns against the long-term, structural reliability benefits that developers argued were necessary?

This is the central tension in all transmission planning: balancing cost and reliability. Opponents, like Pennsylvania’s Office of Consumer Advocate, understandably focus on finding the least expensive solution to an immediate problem. However, PJM’s responsibility is to look at the bigger picture. In this case, NextEra and Exelon successfully argued that their project addressed systemic, structural issues across the entire northeastern part of PJM’s grid. They made the case that you couldn’t just solve these deep-seated problems with smaller, incremental upgrades. PJM’s analysis and the fact that multiple developers proposed similar high-voltage solutions reinforced the idea that a new “backbone” was required to maintain reliability under plausible future scenarios. It’s a judgment call, but PJM ultimately sided with the solution that provided long-term structural integrity over a cheaper, shorter-term fix.

What is your forecast for transmission development?

I foresee an unprecedented acceleration in transmission development, making plans like this one from PJM the new normal rather than the exception. The “electrify everything” movement, the explosion of AI-driven data centers, and the large-scale integration of renewables are creating load growth and grid complexities we haven’t seen in generations. The spending figures from PJM’s recent plans—$6.6 billion in 2023, $5.9 billion in 2024, and now $11.8 billion—show a clear and dramatic upward trend. We are moving from an era of incremental upgrades to an era of building entirely new, high-capacity grid backbones. The primary challenge will shift from just engineering to navigating the complex web of siting, permitting, and public acceptance to get these critical projects built on time.