As the Biden administration strives to advance the agenda of electric vehicles (EVs), it faces significant political hurdles, particularly from opponents like former President Donald Trump. These challenges are intensified by the ongoing struggle to maintain the federal tax credits for EV buyers under the Inflation Reduction Act (IRA). Nonprofits such as Generation180 and the Electric Vehicle Association are doubling down on efforts to emphasize the benefits of these tax credits to legislators, encouraging EV enthusiasts to take a stand.

Political Opposition to EV Incentives

Challenges Posed by Trump Administration

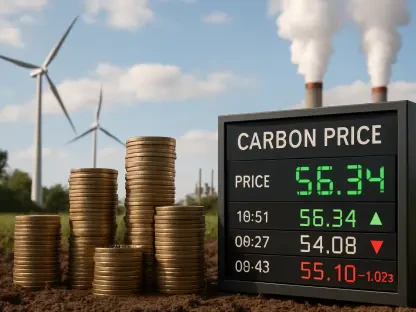

Despite opposition from Trump, the 30D tax credit for purchasing electric vehicles has remained intact, though it may require congressional intervention to safeguard its permanence. The resilience of this tax credit demonstrates its importance and how ingrained it is within federal tax policy. However, the Trump administration’s aggressive rollback on national EV sales targets and freeze on loan incentives for EV infrastructure have played a substantial role in stifling growth in this sector. While rolling back the sales targets strikes notably at the heart of the EV market expansion, it is the suspension of loans and incentives for EV infrastructure that serves as a more profound threat to future industry developments.

Interestingly, a Harvard survey highlights that incentives for EV infrastructure have a greater influence on EV adoption than vehicle tax credits themselves. Without the necessary infrastructure in place, potential EV consumers may shy away from purchasing EVs due to perceived inadequacies in charging facilities. Industry analysts like John Higham underline the broader impacts of this freeze, particularly among Democrats, who must now spend substantial political capital to undo these administrative moves.

Nonprofit Mobilization and Public Advocacy

Organizations such as Generation180 and the Electric Vehicle Association have taken a proactive stance against these discouraging policies. By mobilizing members and leveraging public advocacy, they urge constituents to contact their legislators and highlight the personal and societal benefits they’ve enjoyed from these federal tax credits. These efforts are seen as essential in keeping public and political support firmly behind the incentives that fuel the broader EV adoption movement.

Such initiatives are not without promise; the pressure from grassroots efforts often resonates deeply within political chambers. Higham maintains an optimistic outlook, suggesting that representatives from districts benefiting from job creation due to new EV and battery plants will be protective of these valuable tax credits. This backing can be attributed largely to the economic upswing and employment opportunities associated with the burgeoning EV industry, which has engendered tangible benefits in various local economies.

The Broader Impacts of Revoked Incentives

Economic Effects and Industry Adaptation

The persistent threat of losing federal incentives raises significant concerns about America’s competitive stance in the global EV market. These incentives have inspired investments touching multiple facets of the industry, spanning infrastructure and workforce development to technological innovations. Removing them could potentially price out lower-income Americans from accessing EVs, thwarting the market’s otherwise steady momentum towards inclusivity and broader consumer engagement.

The vital role played by these incentives cannot be undermined. They serve as catalysts for necessary infrastructure developments, which in turn sustain long-term competitiveness and innovation. Federal incentives have been instrumental in propelling companies like General Motors and Toyota to channel significant investments into EV and battery manufacturing plants. This industrial renaissance boosts technological advancements and affirms America’s leading position in a rapidly evolving market.

Perspectives on Sustaining EV Incentives

Automakers have indicated their willingness to step in where federal support might diminish, committing to the independent development of requisite infrastructure. Yet, even as industry giants signal their readiness to bridge potential gaps, concerns linger about the rate of progress and the possible exclusion of socioeconomically disadvantaged groups from the EV movement. Without continued and robust federal support, economic barriers may arise, diminishing the accessibility and appeal of EVs, particularly for lower-income consumers who benefit most from such tax credits.

Gardner, a notable advocate within the EV sphere, proposes that reframing the conversation around innovation and competitiveness rather than social advancement might buffer the support for these incentives. By appealing to broader industrial and economic benefits, there might be sustained or even renewed political backing. The ongoing conversation underscores a crucial juncture where strategic framing could determine the future trajectory of EV adoption and infrastructure growth in the United States.

The Resilience of EV Adoption

Industry Optimism Amidst Challenges

Despite political headwinds, the momentum towards widespread EV adoption seems remarkably resilient. Sales records for EVs continue to be shattered, and consumer preferences are tipping favorably towards electric drivetrains due to their inherent convenience and cost advantages. Both Gardner and Higham assert that the transition towards electrified transportation is inevitable, bolstered by a firm consumer base and the enormous industry investments in EV technology by leading automakers.

The trend towards electrification indicates not merely a phase but a substantial shift reflecting broader societal and economic changes. As major automotive players like General Motors and Toyota entrust their future growth and market strategies to EV technology, they send potent signals about the irreversible journey towards sustainable transportation. This commitment is pivotal, as it underscores the depth of industry confidence in the sustainability and scalability of EV technology.

Societal Benefits and Long-term Implications

As the Biden administration pushes forward with its electric vehicle (EV) agenda, it encounters considerable political obstacles, especially from prominent opponents like former President Donald Trump. This effort is further complicated by the ongoing battle to retain federal tax credits for EV buyers as stipulated in the Inflation Reduction Act (IRA). Nonprofit organizations, including Generation180 and the Electric Vehicle Association, are ramping up their initiatives to underline the advantages of these tax credits to lawmakers. They are fervently encouraging EV enthusiasts and advocates to voice their support. These groups are not just working to preserve the tax credits but are also aiming to promote a broader understanding of the long-term economic and environmental benefits of electric vehicles. Through public engagement and advocacy, they hope to create a more favorable political climate for the adoption and support of EVs, ensuring that the Biden administration’s sustainable transportation goals can be achieved.