A Landmark Investment for a New Era of Energy Demand

In a decisive move that signals a profound shift in the American energy landscape, Duke Energy has unveiled a record-setting $103 billion, five-year capital investment plan—the largest ever announced by a regulated U.S. utility. This monumental financial commitment is not merely a budget increase; it is a strategic response to an unprecedented surge in electricity demand, primarily driven by the explosive growth of energy-intensive data centers. This article will dissect the key components of Duke’s ambitious plan, exploring the forces compelling this investment, the company’s multi-faceted strategy to expand its generation and grid infrastructure, and the significant financial and regulatory challenges that lie ahead. The plan serves as a bellwether for an industry grappling with the dual pressures of powering a digital economy while navigating a complex energy transition.

From Stagnation to Surge: The Shifting Tides of U.S. Electricity Consumption

For over a decade, the U.S. utility sector operated in a predictable environment of relatively flat electricity demand. Energy efficiency gains and the offshoring of manufacturing had created a stable, low-growth market. However, that paradigm has been shattered. The rapid proliferation of data centers, fueled by cloud computing, artificial intelligence, and widespread digitalization, has ignited a demand surge that few had anticipated. This new reality forces utilities like Duke Energy to pivot from a mode of incremental maintenance and modernization to one of aggressive, large-scale expansion. Understanding this historical context is critical; Duke’s $103 billion plan is not just an investment in the future but a race to catch up with a present where digital infrastructure growth is rapidly outstripping the capacity of the existing power grid.

Dissecting the $103 Billion Blueprint

The Data Center Boom: Fueling an Unprecedented Surge in Demand

The primary catalyst behind Duke Energy’s massive spending plan is the exponential growth of the data center industry within its service territories. Unlike traditional industrial or residential customers, these facilities consume vast and constant amounts of electricity, fundamentally altering demand forecasts. The numbers are staggering: since last November, Duke has signed agreements for 1.5 gigawatts (GW) of new data center capacity, bringing its total committed service to this sector to 4.5 GW. More revealing is the future pipeline, which now exceeds 9 GW of potential projects. This demand is transforming Duke’s load profile, leading to a projected retail sales growth of 1.5% to 2% annually—a figure that is exceptionally robust for the utility sector and underscores the urgency of building new generation and grid infrastructure at an accelerated pace.

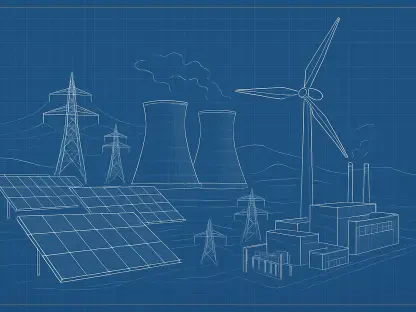

Building the Grid of Tomorrow: A Diversified Approach to Power Generation

To meet this tidal wave of new demand, Duke is pursuing an “all-of-the-above” energy strategy designed to ensure reliability, support economic development, and advance its clean energy goals. The plan allocates capital across a diverse portfolio of assets. Over the next five years, the company aims to add 14 GW of new generation, including 4.5 GW of battery storage to enhance grid stability. Acknowledging the need for dependable, dispatchable power, Duke has already broken ground on 5 GW of new natural gas plants. Simultaneously, it is looking toward a carbon-free future by filing for an early site permit for a small modular nuclear reactor (SMR) in North Carolina. This balanced approach reflects the complex reality of today’s energy transition, where intermittent renewables must be backed by firm power sources to maintain a resilient grid capable of powering a modern economy.

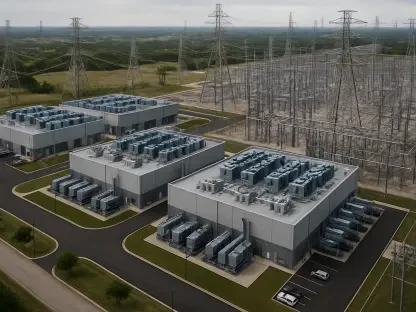

Financing the Future: Capital Strategy and the Regulatory Hurdles

Funding a $103 billion capital expenditure is a colossal undertaking that requires a sophisticated financial and regulatory strategy. To underwrite this growth, Duke plans to issue approximately $10 billion in new equity between 2027 and 2030, while also exploring alternative financing vehicles. In the near term, the company is bolstering its balance sheet through strategic asset sales, such as the pending $2.48 billion divestiture of Piedmont Natural Gas Tennessee. However, the most critical component is cost recovery through customer rates. This massive investment will inevitably translate to higher electricity bills for the 8.7 million customers it serves. Consequently, Duke must successfully navigate complex rate cases before state regulators in the Carolinas, Florida, and the Midwest, making the case that these investments are prudent and necessary to ensure a reliable and affordable energy future.

Beyond the Five-Year Plan: What Duke’s Strategy Signals for the Future of Energy

Duke Energy’s record-setting plan is more than an internal corporate strategy; it is a clear indicator of a broader industry-wide transformation. Other utilities across the nation are facing similar demand pressures from data centers and the reshoring of manufacturing, forcing a collective re-evaluation of long-term resource planning. The success of Duke’s plan will hinge not only on its execution but also on technological innovation, particularly in areas like advanced nuclear (SMRs) and long-duration energy storage. Furthermore, it underscores the evolving partnership between utilities, technology giants, and regulators, who must collaborate to develop new frameworks for energy procurement, rate design, and infrastructure deployment that can match the speed and scale of the digital economy.

Key Insights and Strategic Imperatives for a Power-Hungry World

The analysis of Duke Energy’s historic spending plan yields several crucial takeaways. First, the era of flat electricity demand is definitively over, and the digital economy is now the primary driver of growth. Second, meeting this demand reliably requires a pragmatic, diversified generation portfolio that leverages natural gas for dependability while aggressively expanding renewables, storage, and advanced nuclear for a cleaner future. Finally, executing such a transformation requires a clear-eyed financial strategy and a constructive regulatory environment that allows for timely investment recovery. For businesses and consumers, this signals a future where electricity is an increasingly critical, and likely more expensive, component of economic life, heightening the importance of energy efficiency and demand-side management.

A New Energy Chapter Begins

Duke Energy’s $103 billion commitment marks the beginning of a new chapter for the American utility sector—one defined by rapid growth, massive infrastructure builds, and the complex challenge of balancing reliability, affordability, and sustainability. The core theme is clear: the energy grid is no longer just a silent partner to the economy but a central enabler of its future growth. As the digital and physical worlds become ever more intertwined, the success of ambitious plans like Duke’s will determine the nation’s ability to lead in the 21st century. The path forward demands bold investment, technological innovation, and a shared understanding that a strong economy requires an equally strong and modern power grid.