Introduction

In an era where the global energy landscape is undergoing a seismic shift toward decarbonization and electrification, power electronics have emerged as the linchpin for enabling efficient energy conversion and grid stability, making them a critical focus for B2B stakeholders in industrial and technology sectors. The relentless growth of renewable energy sources, electric vehicle adoption, and grid modernization initiatives has created an unprecedented demand for advanced technologies like High-Voltage Direct Current (HVDC) systems, inverters, and wide-bandgap semiconductors such as Silicon Carbide (SiC) and Gallium Nitride (GaN). For business leaders and procurement managers, identifying the right investment opportunities in this space is not just about financial returns—it’s about aligning with partners who can deliver scalable, future-proof solutions to meet ambitious sustainability targets.

This editorial delves into the strategic considerations for selecting power electronics stocks poised for dominance in the current market environment. It explores the market dynamics driving growth, evaluates key players across different segments, and highlights the risks that could impact long-term value. By focusing on business outcomes rather than technical minutiae, the aim is to equip decision-makers with actionable insights to navigate a sector that is both high-growth and high-stakes, ensuring investments align with operational needs and strategic goals in an increasingly electrified world.

Navigating the Power Electronics Investment Landscape

The power electronics sector is at a pivotal moment, fueled by structural shifts in energy and transportation that demand robust infrastructure and cutting-edge components. For B2B professionals, the challenge lies in discerning which companies can translate technological leadership into sustainable business value. Market projections indicate robust growth through 2025 to 2030, particularly in HVDC systems critical for integrating renewable energy over long distances, with Europe’s interconnector projects and U.S. transmission upgrades serving as prime examples of escalating demand. Companies with expertise in these areas are likely to secure multi-year contracts, offering stability for investors focused on predictable revenue streams.

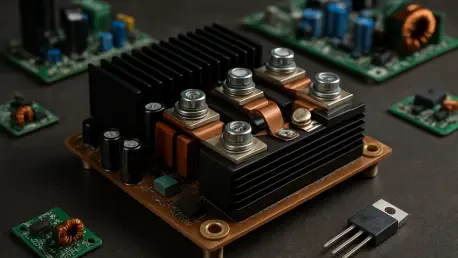

A parallel trend reshaping the investment calculus is the rapid adoption of wide-bandgap semiconductors like SiC and GaN, which offer superior efficiency and reduced energy losses compared to traditional silicon solutions. These materials are becoming mainstream in electric vehicle powertrains and renewable energy inverters, with market leaders such as Infineon and Wolfspeed driving innovation. For businesses reliant on high-performance components, partnering with or investing in firms that hold intellectual property in these technologies can yield competitive advantages, especially as demand in high-growth end markets like data centers continues to surge.

However, the landscape is not without pitfalls that require careful strategic planning. Semiconductor cyclicality, supply chain constraints, and competition from lower-cost Asian manufacturers pose significant risks to profitability. Additionally, the capital-intensive nature of projects like HVDC installations means that balance sheet strength and execution capabilities are critical metrics for evaluating potential investments. B2B stakeholders must prioritize companies with proven scalability and diversified exposure to mitigate these risks, ensuring that operational disruptions do not derail long-term partnerships or supply agreements.

Conclusion

Looking back, the exploration of the power electronics sector reveals a dynamic interplay of innovation, demand, and risk that shapes investment priorities for B2B professionals. The focus on HVDC expertise, wide-bandgap semiconductor advancements, and financial resilience offers a framework for identifying stocks with enduring potential. As the energy transition accelerates, decision-makers are encouraged to align with firms demonstrating strong order backlogs and technological moats, while remaining vigilant about competitive and geopolitical challenges. This strategic approach can position businesses to capitalize on electrification trends, fostering partnerships that drive both sustainability and profitability in the years ahead.