Unraveling the Stakes in Clean Energy Funding

Imagine a landscape where clean energy access for low-income communities hangs by a thread, threatened by policy shifts that could reshape the renewable sector overnight. The Environmental Protection Agency (EPA) stands poised to potentially terminate the $7 billion Solar For All program, a pivotal initiative under the Inflation Reduction Act (IRA). This market analysis dives into the implications of such a decision, dissecting current trends, data, and projections for the solar industry and environmental equity. With billions in funding at risk, understanding these dynamics is critical for stakeholders navigating an increasingly volatile energy market.

Diving Deep into Market Trends and Projections

Program Impact and Solar Market Growth

The Solar For All program has been a catalyst for expanding solar access, targeting disadvantaged households with no-cost or low-cost solutions across 49 states. With $7 billion allocated to 60 recipients, including state agencies and nonprofits, the initiative has fueled projects like community solar deployments and zero-interest loans. Data indicates that such efforts have driven a measurable uptick in solar adoption among low-income demographics, a segment historically underserved by renewable energy markets. This growth not only reduces energy costs for vulnerable populations but also contributes to a broader reduction in greenhouse gas emissions, aligning with national climate goals.

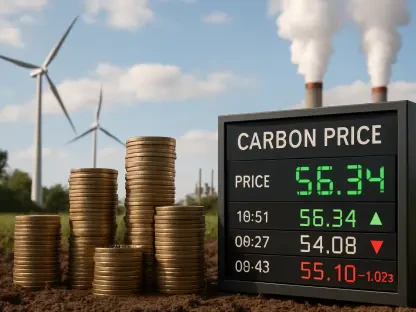

Policy Shifts as a Market Disruptor

Recent policy moves under the Trump administration, particularly through the One Big Beautiful Bill (OBBBA), have introduced significant uncertainty into the clean energy sector. The OBBBA’s repeal of key Clean Air Act provisions tied to the Greenhouse Gas Reduction Fund (GGRF) directly threatens programs like Solar For All. Market analysts note that an executive order earlier this year briefly froze funding, and the looming possibility of complete termination could stall ongoing projects. This political turbulence creates a chilling effect, potentially deterring private investment in solar initiatives as companies reassess risks associated with federal funding volatility.

Legal and Contractual Headwinds Affecting Stability

The legal landscape adds another layer of complexity to the market outlook. A substantial portion of the $7 billion has already been obligated through binding contracts with grantees, making termination a potential trigger for lawsuits. Legal experts anticipate challenges similar to past disputes over frozen GGRF funds, which could tie up resources and delay project timelines. For solar industry players, this uncertainty translates into hesitancy around long-term commitments, as the threat of litigation and disrupted funding streams looms large over strategic planning and market expansion.

Community Demand and Stakeholder Sentiment

Stakeholder reactions highlight a robust demand for programs like Solar For All, with community enrollment numbers painting a compelling picture. In Georgia, for instance, nearly 500 households joined a no-cost solar initiative within a single day of its launch, underscoring the market’s appetite for accessible renewable solutions. Environmental advocacy groups and state agencies warn that cancellation would derail “shovel-ready” projects, directly impacting local economies and job creation in the solar sector. This groundswell of opposition signals a potential backlash that could influence market sentiment, pushing investors to seek more stable opportunities elsewhere.

Forecasting the Ripple Effects on Clean Energy

Looking ahead, the potential end of Solar For All could reshape clean energy funding trajectories through at least the next two years, from now until 2027. Projections suggest that a sustained rollback of IRA-linked initiatives might suppress growth in the community solar segment, which has seen annual increases due to federal support. Technological advancements in solar affordability could partially offset losses, but only if alternative funding mechanisms emerge. Additionally, state-level renewable targets may clash with federal priorities, creating fragmented markets where regional disparities in solar adoption widen, further complicating national forecasts.

Reflecting on Market Implications and Strategic Pathways

Looking back, this analysis unpacked the precarious position of the Solar For All program amid political, legal, and community pressures, revealing how deeply intertwined federal policy is with clean energy market dynamics. The potential loss of $7 billion in funding stood as a stark warning of disrupted growth and diminished environmental equity. For industry stakeholders, the path forward demanded proactive measures—securing private partnerships to bridge funding gaps proved essential, as did advocating for state-level policies to sustain momentum. Legal preparedness emerged as a key strategy, with grantees bracing for battles over contractual obligations. Ultimately, navigating this uncertainty required a blend of innovation and resilience, ensuring that the solar sector could adapt to policy shocks while still championing accessible, sustainable energy solutions for all.