With a deep background in energy management and electricity delivery, Christopher Hailstone is uniquely positioned to dissect the complex forces shaping today’s metals markets. As our go-to utilities expert, he offers critical insights into how narratives around grid reliability and next-generation technology are colliding with market fundamentals.

This conversation delves into the heart of the 2025 copper market frenzy. We will explore the tangible demand stemming from the artificial intelligence boom, weigh it against historical parallels to the dot-com bubble, and decode the subtle yet significant signals from global pricing spreads that suggest the full story may be more complicated than the headlines suggest.

The article links the copper price spike to AI data centers, which reportedly drove 92% of early 2025 U.S. GDP growth. Could you break down the specific copper-intensive applications within these facilities and explain how you quantify this new demand versus traditional industrial sources?

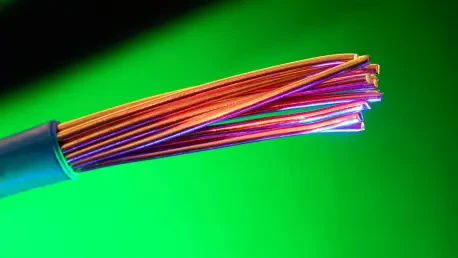

It’s a staggering figure, and it speaks to the sheer scale of this buildout. When you look inside one of these new data centers, you see copper everywhere. It’s in the high-voltage power distribution systems, the busbars, the grounding wires, and miles of cabling connecting servers. But the demand story doesn’t stop at the facility’s walls. These “hyperscalers,” with capital spending approaching $400 billion, are placing an unprecedented load on our electrical grid. This creates a secondary wave of demand for grid upgrades—new transformers, substations, and transmission lines, all of which are incredibly copper-intensive. So we’re not just quantifying the copper inside the data centers; we’re also factoring in the massive infrastructure buildout required to simply keep them powered.

John Gross draws a compelling parallel between the current AI boom and the dot-com era’s fiber optic overbuild. Beyond the general hype, what specific metrics or market behaviors are you tracking that suggest we might be overestimating future copper demand, similar to how bandwidth was miscalculated then?

That’s a brilliant and frankly, a much-needed, historical parallel. The story of Global Crossing is a cautionary tale about betting the farm on a revolutionary narrative. Back then, the thesis was that the internet would require infinite bandwidth, but the actual demand couldn’t keep pace with the speculative buildout. Today, the narrative is that AI requires infinite power and data, but we have to ask the same hard questions. The primary metric I’m watching is the spread between the Comex and LME prices. When a market is truly and fundamentally tight, that premium should be wide and sustained. The fact that it’s collapsing tells me physical material is flowing to meet demand, and the panic might be subsiding. It’s an echo of the dot-com era, where the narrative of “owning the future” got way out ahead of the underlying reality.

The piece notes copper hit a record $5.80 per pound in July 2025, yet the Comex premium over the LME has since shrunk from 17 cents to just 4.6 cents. Please walk us through the mechanics of this spread and explain what its rapid decline signals about global supply flows.

The Comex-LME spread is essentially a barometer for regional market tightness. A high premium, like the 17 cents we saw in October, signals that it’s much more difficult or expensive to get physical copper in the U.S. than it is in the global market represented by London. It screamed that the U.S. was the hot spot. The rapid decline to just 4.6 cents is incredibly significant. It tells us that global arbitrage is working; metal is moving from areas of surplus to the U.S. to capture that premium. This flow of metal is relieving the pressure that drove prices to that record $5.80. It’s a classic market response, and it strongly suggests that the acute U.S. supply crunch that characterized mid-2025 is easing, and the market is rebalancing on a global scale.

A potential tariff was cited as a key price driver in the U.S. From your conversations in the industry, how much of the 2025 price surge was due to this tariff speculation versus actual consumption? Can you share any anecdotes on how companies adjusted their purchasing strategies?

The tariff threat was a massive accelerant. The specter of material suddenly becoming up to 50 percent more expensive than in Europe or China created an absolute frenzy. While the AI story was the long-term narrative, the tariff talk was the short-term panic button. I can tell you, we saw purchasing managers who would normally order on a quarterly basis suddenly trying to secure six to nine months of inventory overnight. It became less about immediate production needs and more about hedging against a policy decision. This speculative buying created an artificial demand shock, pulling future consumption into the present and making the market feel significantly tighter than it actually was. It’s very difficult to separate from real AI demand, but it absolutely poured gasoline on the fire.

What is your forecast for the copper market in 2026, especially regarding the balance between the powerful AI demand narrative and the potential for a market correction?

Looking ahead to 2026, I see a market caught in a tug-of-war. On one side, you have the undeniable, powerful demand from the AI and electrification buildout. That is a real, structural shift that isn’t going away. However, on the other side, you have a market that got ahead of itself in 2025, fueled by speculative tariff fears and a dot-com-style narrative. While some analysts are calling for another new record high, I urge caution. The collapsing Comex premium is a major red flag that the period of exceptional U.S. tightness is ending. I believe 2026 will be a year of reconciliation, where the market tries to find a true equilibrium between the powerful long-term story and the short-term realities of global supply and demand. We may see prices remain strong, but the parabolic, frenzied rise of 2025 is likely behind us.