With us today is Christopher Hailstone, a leading expert in industrial energy management and grid infrastructure. He’s here to unpack a new roadmap that charts a course for the U.K. metals recycling industry to achieve net-zero emissions. We’ll explore the ambitious technological shifts required, like the move to electric arc furnaces, and discuss the critical day-to-day operational changes that will drive this transformation. We’ll also delve into the significant financial and policy hurdles the industry faces, from fuel duties on biofuels to the urgent need for grid upgrades and fairer, science-based standards that don’t penalize recycling.

The transition to electric arc furnace (EAF) steelmaking is projected to cut the industry’s emissions footprint by an impressive 38 percent. Could you detail the specific processes that achieve this reduction and explain the main operational and financial hurdles preventing a wider, faster adoption?

Certainly. The beauty of EAF steelmaking is that it sidesteps the most carbon-intensive part of traditional steel production: the blast furnace. Instead of using coal to melt raw iron ore, an EAF uses massive amounts of electricity to melt recycled scrap steel. This switch alone is what drives that huge 38 percent reduction in the industry’s overall footprint. You’re essentially cutting out the primary source of direct emissions. However, the hurdles are just as massive as the furnaces themselves. Operationally, you need an enormous, stable, and reliable supply of electricity, which is a major challenge for our current grid. Financially, the capital expenditure is staggering. We’re talking about not just the furnace but also the supporting infrastructure—the high-capacity power connections, substations, and internal wiring. For many operators, securing that level of private financing for such a long-term investment without some form of government backing is simply out of reach.

A 93 percent reduction in direct Scope 1 and 2 emissions by 2050 is an ambitious goal. Beyond major furnace changes, what are the most critical day-to-day operational shifts and equipment upgrades recyclers must make to reach this target? Please provide some concrete examples.

That 93 percent figure is absolutely achievable, but it requires a fundamental rethinking of daily operations. The big furnace changes get the headlines, but the real work happens on the ground, every single day. The biggest shift will be moving away from diesel-powered equipment. Think about a typical metals recycling yard: you have shredders, balers, shears, and a fleet of heavy vehicles like loaders and haulers, all running on fossil fuels. Each one of these needs to be electrified or switched to a low-carbon alternative. For example, swapping a diesel-powered mobile shear for an electric one eliminates on-site emissions entirely. Another key area is transportation. Many operators are looking at biofuels like hydrotreated vegetable oil (HVO) as a bridge fuel for their vehicle fleets. These small, incremental changes, when multiplied across the entire industry, are what add up to that dramatic 93 percent reduction in direct emissions. It’s a piece-by-piece revolution.

One recommendation is a 10-pence-per-liter fuel duty reduction for biofuels like HVO. How would this directly impact a typical recycler’s operating costs, and what practical steps would operators need to take to adapt their existing vehicle fleets to utilize these fuels effectively?

A 10-pence reduction would be a game-changer for operating margins. Fuel is one of the largest and most volatile costs for any recycler. The price of biofuels like HVO is often higher than conventional diesel, which creates a significant barrier to adoption, even for environmentally-conscious operators. This duty reduction would make HVO directly price-competitive, immediately lowering the financial risk of making the switch. The practical side of this is surprisingly straightforward, which is why it’s such a compelling policy. HVO is often called a “drop-in” fuel, meaning it can be used in most modern diesel engines without any significant modifications to the vehicles. An operator could literally decide on Monday to switch, place an order, and start fueling their existing fleet with HVO on Tuesday. It’s one of the most immediate and impactful steps an operator can take to slash their carbon footprint without the massive capital outlay and downtime associated with replacing an entire fleet.

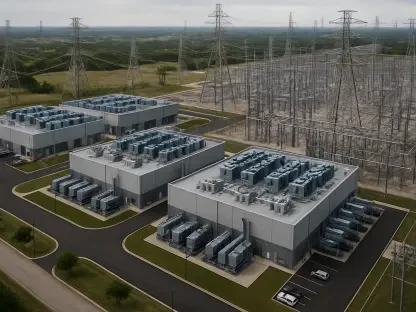

The call for affordable financing for grid infrastructure highlights a key challenge. Can you describe the specific power connection and capacity issues recyclers currently face and explain how government-backed, low-interest loans would enable the transition to more sustainable, electricity-powered processes?

The grid issue is the elephant in the room for our industry’s decarbonization. When a recycler decides to electrify a large piece of machinery, like a shredder, they can’t just plug it in. They often need a brand-new, high-capacity connection to the national grid, which can involve laying miles of cable and building a dedicated substation. The wait times for these connections can be years long, and the costs can run into the millions. These are not expenses that most businesses can easily absorb. Government-backed, low-interest loans would break this logjam. They would de-risk the investment, allowing operators to finance these essential grid upgrades over a manageable period. It enables them to say “yes” to electrifying their processes because the single biggest financial barrier has been removed. Without this support, many operators are stuck, wanting to invest in cleaner technology but unable to secure the very power needed to run it.

Adopting science-based standards that do not penalize recycled content is a key policy ask. Please explain how some current standards can disadvantage recycled metals against primary production and how this shift would bolster the industry’s environmental credentials and global competitiveness.

This is a subtle but incredibly important point. Many existing carbon accounting standards are designed around primary manufacturing. They focus heavily on the direct emissions from a single factory or furnace. When you make steel from iron ore, you can control that process and measure the emissions. But when you use recycled steel, the “product” has already had a life, and its environmental benefits—the avoided emissions from mining, processing, and shipping raw materials—are often not fully credited. This can create a perverse situation where steel made from recycled scrap appears less “green” on paper than primary steel from a hyper-efficient, but still fundamentally carbon-intensive, new plant. Adopting a more holistic, science-based standard, like the one proposed by the Global Steel Climate Council, levels the playing field. It properly accounts for the massive carbon savings inherent in recycling, which strengthens the business case for using recycled content and enhances the global competitiveness of U.K. recyclers who are at the forefront of the circular economy.

What is your forecast for the U.K. metals recycling industry’s journey to net-zero?

I am fundamentally optimistic, but it’s an optimism conditioned on partnership. The industry has a clear, data-driven roadmap showing that a 93 percent reduction in direct emissions and a 70 percent cut in the total footprint are within our grasp. The technology and the will are there. However, the industry cannot do it alone. The journey’s pace and ultimate success will be determined by the policy environment. If the government implements supportive measures like the fuel duty reduction for biofuels, provides financing for critical grid upgrades, and champions standards that fairly value recycled materials, we can accelerate this transition dramatically. My forecast is that the U.K. metals recycling industry has a genuine opportunity to be the first in the world to produce net-zero recycled metal, but that “first in the world” title depends entirely on collaborative action and smart, targeted policy in the very near future.